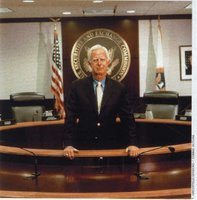

This past weekend, Arthur Levitt, Jr., the former chairman of the Securities and Exchange Commission, outlined in the Wall Street Journal a few proposals for reforming the way U.S. financial markets are regulated. (Unfortunately, you need a subscription to read the article.) His article is actually something of an expansion on some ideas he presented in a few speeches previously (including one in October 2004 in New York). But he also proposes a few additional consolidations: particularly, merging the SEC with the Commodity Futures Trading Commission.

Combining the regulatory arms of the exchanges (which, in the United States, are also called "self-regulatory organizations" or "SROs") would make a lot of sense. Many people don't realize that the bulk of day-to-day oversight of U.S. stock markets is not conducted by the SEC, but by the exchanges themselves. It is the regulatory arms of the exchanges that have huge computers running complex algorithms that notice the slightest trading anomalies that, in turn, lead to insider trading and market manipulation investigations by the SEC. And the exchanges generally do a good job at this. At the same time, there are some pretty clear conflicts of interest in this situation, particularly when the exchange is itself a public corporation (and its shares trade on its own exchange).

Because American exchanges have mostly demutualized (i.e., gone public), and everyone is looking to merge with everyone else (across borders and otherwise), it makes sense for this self-regulatory aspect of the exchanges to be carved out of what is otherwise a business. Self-regulation is a holdover from the 1930s. The exchanges regulated their members before the 1934 Securities Exchange Act was signed by Franklin Roosevelt, and self-regulation was a minor sop thrown their way to help easy the humiliation they were to suffer by having to answer to a federal regulatory agency. It has remained because, truth be told, the SEC does not have the resources or expertise to conduct the kind of day-to-day compliance monitoring that the SROs now do. But that does not mean that these private-sector regulators must remain nominally part of the businesses they oversee.

I do not mean to imply by this that the SRO regulators are compromised by this connection they have to the exchanges. There are sufficient operational walls and legal barriers between the regulatory folks and the business operations folks at the New York Stock Exchange and National Association of Securities Dealers (and the SEC constantly looking over their shoulders) to prevent this. But this also means that, because the regulators are so cut off from the business sides of the exchanges, cutting them completely away from the business would be relatively easy. And, as Levitt mentions, combining the regulatory arms of the New York Stock Exchange, the NASD and the National Futures Association would create some operational efficiencies and provide unitary oversight of all securities and futures broker-dealers.

Levitt's more interesting proposal is to combine the SEC with the CFTC. This is by no means a new idea. Levitt's predecessor, Richard Breeden (and even his precedessor, David Ruder) actually tried to do this. By most accounts, the reason that Breeden's and Ruder's attempts were unsuccessful is that (1) the SEC and CFTC are overseen by two separate committees in both the Senate and the House (and it's unlikely the the agricultural committees would get to hold onto oversight of a financial regulator if the CFTC merged with the SEC), and (2) to some extent the CFTC was created precisely because some in Congress didn't want U.S. futures markets to be regulated by an agency as strong as the SEC. The SEC was created in 1934, arguably at the nadir of corporate power in the United States. Unlike the Federal Reserve (or the CFTC, for that matter), the SEC is dominated by lawyers, not economists. And despite what former SEC chairman Harvey Pitt is said to have told the SEC senior staff at his first meeting with them, the SEC is a law enforcement agency and a regulatory agency, not just a regulatory agency with a some law enforcement powers. Or, at least, that is what many investors and voters believe.

The CFTC, by contrast, was created at a time when corporate America was back on its feet and Richard Nixon (and then Gerald Ford) were in the White House. It generally has a reputation for being the American version of the United Kingdom's Financial Services Authority—a place that takes a "light touch" to regulating.

There are some very good reasons for combining the SEC with the CFTC. Futures and securities markets, in particular, are so closely intertwined that separate regulation doesn't make much sense and can easily lead to regulatory gaps. (Or the opposite, overlapping regulation). At the same time, Levitt's proposal begs the question of why stop there. Banking and securities markets are also intertwined, and many major economies have moved to "consolidated regulation" with a single financial regulator (such as the UK FSA) overseeing securities, futures, banking and insurance markets. If we combine the SEC and the CFTC, why not also add in the Federal Reserve, FDIC, Comptroller of the Currency, etc.?

Levitt's answer is a good one, but one wonders if it is sufficient. The Federal Reserve (like most banking regulators) is a "prudential" regulator. As Levitt notes:

That does not mean we should create one super-regulatory agency. For instance, the Federal Reserve's regulatory functions in the banking industry should remain separate. While including the Fed in such a merger may make sense on the surface, it would not work. The Fed's dominant regulatory culture is one of safety and soundness, far different than the focus on dynamism, risk and investor protection found at the SEC or CFTC.For the Fed, reputation matters most, and sometimes it will overlook a few "questionable activities" if asking questions might cause the public to lose confidence in the banking system. The SEC, by contrast, in many ways takes a far gentler regulatory touch to allowing new investment products and vehicles—but tends to favor public hangings when rules are violated.

But Levitt's point also applies to the SEC and CFTC. In essence, the Federal Reserve has a different regulatory philosophy than the SEC. Yet the CFTC also has a different regulatory philosophy. And, while Levitt argues that "a single federal regulator of securities also would advance and maintain our pre-eminent role in the world's financial markets, by better equipping the U.S. to address directly the looming issues of global harmonization of regulatory practices," the truth of the matter is that it is not the CFTC that is standing in the way of global harmonization. (Heck, in the past, the CFTC was more than willing to give away the store, as the recent debate over the Intercontinental Exchange demonstrates.) That said, is there not something to be said for inter-agency competition? After all, hasn't the CFTC's willingness to experiment with "mutual recognition" of foreign securities regulation (a decision which underlies the ICE controversy) shown the SEC both what can be done and the pitfalls that lie ahead? With a single financial regulator, would there be as much regulatory experimentation?

No comments:

Post a Comment